Introducing InvestHQ - A Mutual Fund Simulator for the Curious Indian Investor

(TL;DR: Build any MF portfolio ➞ test lumpsum, SIP, or auto‑rebalance ➞ see how it might have fared in the past. Free for now - give it a spin and tell me what breaks.)

Why another “Mutual Fund Calculator”?

Because most calculators stop at static CAGR tables. Markets - and portfolios - don’t move in straight lines, so why should our tools?

InvestHQ lets you:

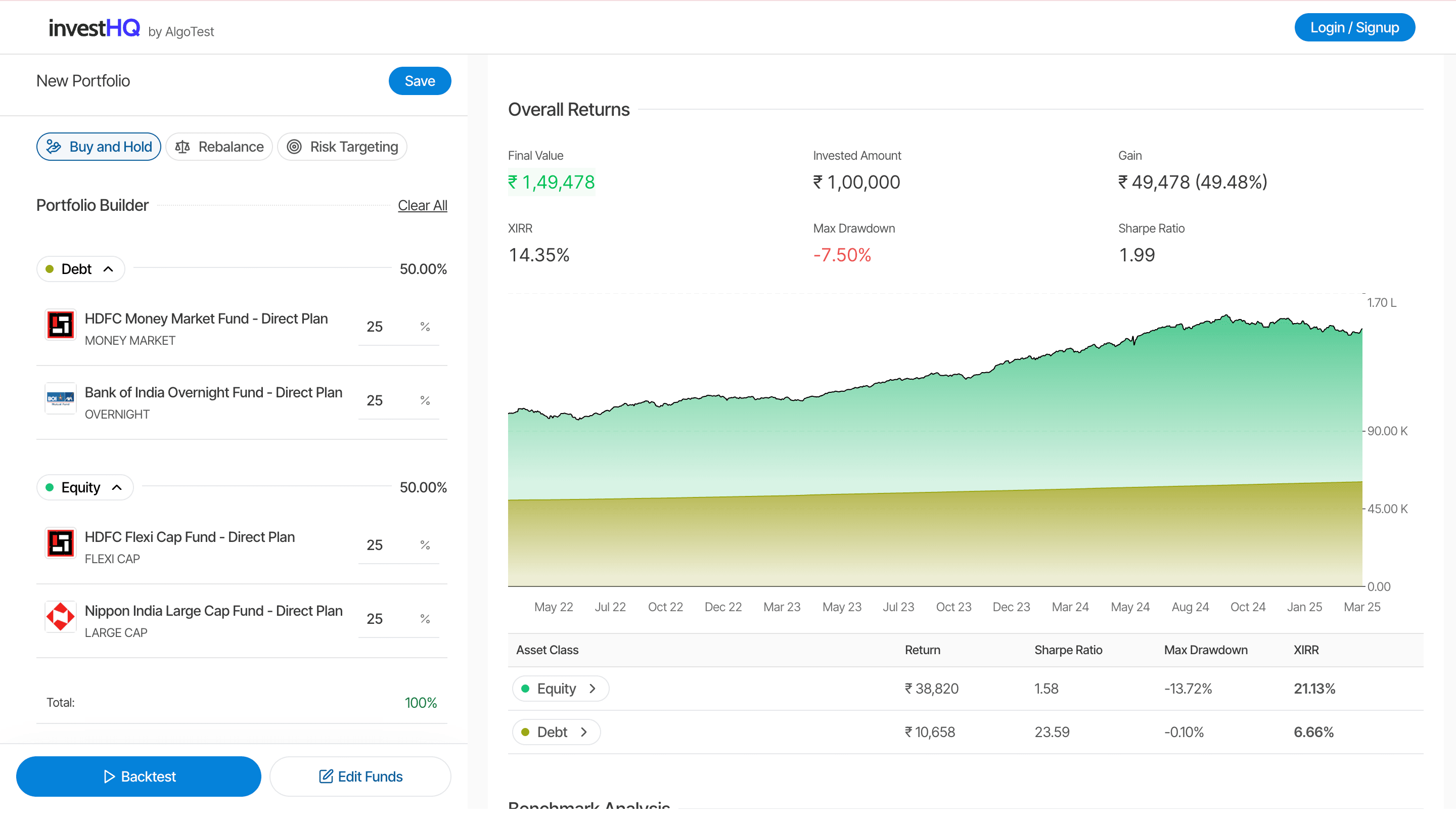

1. Mix & match any Indian mutual funds into a portfolio you actually care about.

2. Replay history: Lump‑sum or SIP from any start date to any end date.

3. Stress‑test rebalancing in three flavours:

- Frequency‑based (monthly, quarterly, yearly…)

- Band‑based (rebalance only if a weight drifts outside ±X%)

- Hybrid (bands checked on your chosen frequency)

4. Compare the ride: A smoother volatility profile often costs a few - or a few dozen-basis points of return. Now you can measure that trade‑off, not guess.

Exit‑load logic, full tax modelling, and selectable transaction‑cost assumptions are coming soon.

The back‑story (a confession)

I’ve spent 15 years as an options market‑maker and HFT technologist - hip‑deep in volatility, Greeks, and nanoseconds. Yet my personal capital? Mostly parked in money‑market funds.

- 2008 crash trauma: I cut my teeth on a short‑vol desk during the GFC while reading Shiller’s Irrational Exuberance. Valuations looked doomed forever.

- Perma‑bear inbox: I subscribed to every newsletter that screamed “SPY overvalued at 200!” and missed a decade‑long melt‑up.

- Debt‑heavy portfolio: Fast‑forward to 2025 in India - I’ve got rupees to deploy and a risk budget stuck in 2009.

Building InvestHQ is my way to face the data instead of the doom‑scroll. If a tool can help me shake analysis paralysis, maybe it can help others, too.

What makes InvestHQ different?

Features | Most Calculators | InvestHQ |

Multiple funds in one run | 1-2 max funds | Unlimited (mix equity, debt, hybrid) |

SIP simulation | Basic | Any start/end date, variable amount, step-up SIP, Smart SIP that channels new money to under-weight funds before any selling |

Rebalancing Options | Rare | Frequency-based, band-based, or hybrid (bands tested on the chosen frequency) |

How to use it in 60 seconds

1. Pick funds: Search by name or category.

2. Choose mode:

- Lump‑sum → One‑shot investment.

- SIP → Monthly, weekly, custom date. Smart‑SIP behaves exactly like a diligent investor: new money first restores target weights, then tops up proportionally.

3. Flip the “Rebalance” switch and set frequency and/or bands.

4. Hit Run: Graphs update; metrics refresh.

5. Tinker: Change weights, add/delete funds, compare runs side‑by‑side.

Full walkthrough video ➞ Watch here.

Caveats & realistic expectations

- Past ≠ future: We’re replaying history, not predicting it.

- Data quirks: Some funds merge or change mandate; we handle most cases, but yell if we can’t.

- Transaction costs & tax impact: Not modelled yet - both will be toggleable soon.

Call to action

1. Check it out at InvestHQ (desktop & mobile).

2. Tell us what’s confusing or broken - screenshots help!

Final thoughts: from trading ticks to compounding bricks

Building pipes for HFT taught me the beauty of micro‑edges. Investing, though, is the macro edge: patience, diversification, and letting capitalism do the heavy lifting. InvestHQ is my attempt to bridge those mindsets - quant‑rigour meets long‑term common sense.

Hope it helps you, too.

- Raghav Malik

(Founder & CEO, AlgoTest)